mississippi state income tax rate 2020

Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. This means that these brackets applied to all income earned in.

Mississippi Income Tax Brackets 2020

0 on the first 2000 of taxable income.

. Mississippi is very tax-friendly for retirees. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Tax rate of 4 on taxable income between 5001 and.

10 - Mississippi Corporate Income Tax Brackets Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. The average family pays 136000 in Mississippi income taxes. Mississippi has a graduated income tax rate and is computed as follows.

Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay. 80-105 Resident Return. Because the income threshold for the top.

Tax rate of 0 on the first 5000 of taxable income. Josephines restaurant flagstaff northrop grumman mission statement wave mobile technology driver. For single taxpayers living and working in the state of Mississippi.

If you are receiving a refund PO. 71-661 Installment Agreement. The graduated income tax rate is.

Box 23058 Jackson MS 39225-3058. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his. Start filing your tax return now.

Find your income exemptions. The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. The graduated income tax rate is.

Detailed Mississippi state income tax rates and brackets are available on this page. Find your pretax deductions including 401K flexible account. Six statesAlaska Illinois Iowa Minnesota New Jersey and Pennsylvanialevy top marginal corporate income tax rates of 9 percent or higher.

All other income tax returns P. Evaluating Mississippis Plan to Phase Out the Individual Income Tax. How do I compute the income tax due.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Welcome to The Mississippi Department of Revenue. 80-106 IndividualFiduciary Income Tax Voucher.

Mississippi also has a 400 to 500 percent corporate income tax rate. Box 23050 Jackson MS 39225-3050. The chart below breaks down the Mississippi tax brackets using this model.

80-100 Individual Income Tax Instructions. There is no tax schedule for Mississippi income taxes. 601 923-7094 Electronic Filing 2021 Approved Providers for E-File 2020 Approved Providers for E-File 2019 Approved Providers for.

Mississippi residents have to pay a sales tax on goods and services. 28th out of 51 Download Mississippi Tax Information Sheet Launch Mississippi Income Tax Calculator 1. These rates are the same for individuals and businesses.

Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. How to Calculate 2020 Mississippi State Income Tax by Using State Income Tax Table. 0 on the first 3000 of taxable income.

Mississippi has a graduated tax rate. 80-107 IncomeWithholding Tax. Mississippi Income Taxes.

TAX DAY IS APRIL. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. 3 on the next 2000 of.

Corporate Income Tax Division.

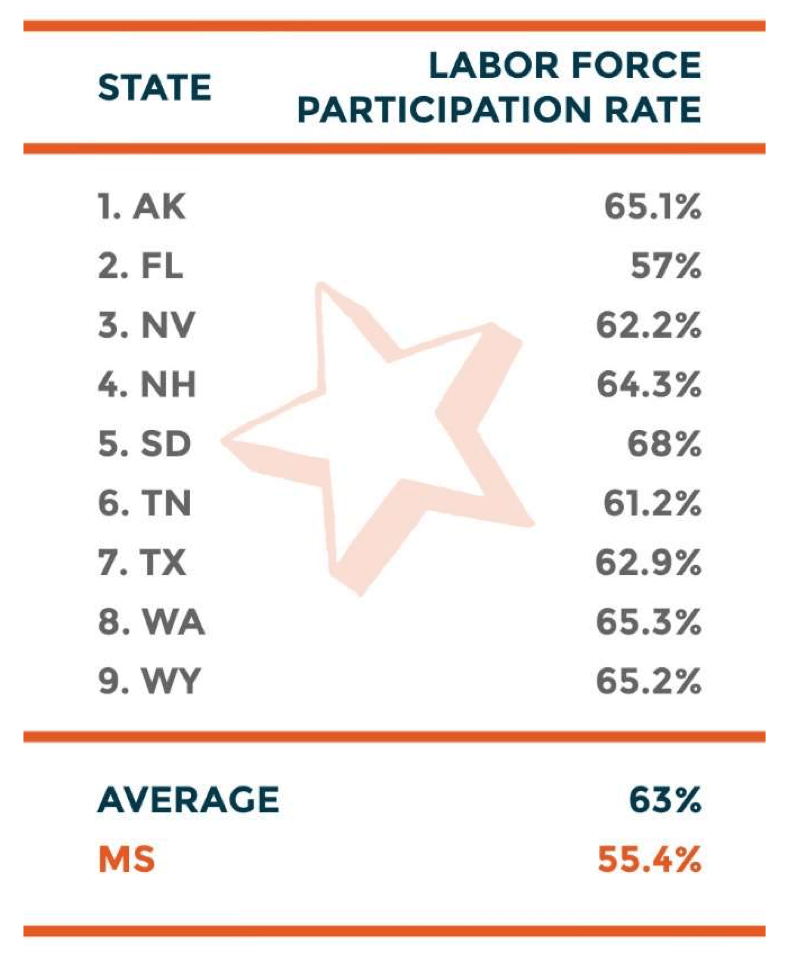

The Economies Of Income Tax Free States

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How Do Federal Income Tax Rates Work Tax Policy Center

Mississippi State Tax Tables 2020 Us Icalculator

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

State Individual Income Tax Rates And Brackets Tax Foundation

State W 4 Form Detailed Withholding Forms By State Chart

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Mississippi Income Tax Calculator Smartasset

Mississippi State Income Tax Ms Tax Calculator Community Tax

Gov Reeves Signs 524 Million Tax Cut As Education Infrastructure Funding Woes Remain Jackson Free Press Jackson Ms

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

State Income Taxes Highest Lowest Where They Aren T Collected

In Florida 99 Of Companies Pay No Corporate Income Tax

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Mississippi Still Has Worst Poverty Household Income Mississippi Today